હવે સસ્તી હોટલ પર પણ લાગશે GST, બ્રાન્ડેડ ચીઝ, દહીં, મધ ખાવા મોંઘા થશેઃ ચેક ઇશ્યૂ કરવા પર બેંકો દ્વારા વસૂલવામાં આવતા ચાર્જ પર ૧૮ ટકા GST વસૂલવામાં આવશે

29-Jun-2022

હવે ગુજરાતી ભાષામાં અનુવાદ કરો

It will be more expensive to eat branded cheese, yoghurt, honey: 12 per cent GST will be levied on the charges levied by banks on issuing checks.

GST will now be levied on affordable hotels, also on ready-made cheese and yoghurt: GST Council has accepted most of the recommendations of the group of finance ministers of the states.

Chandigarh: Canned and labeled or branded items like curd, cheese, honey, meat and fish will now become more expensive. This is because it has been decided to impose Goods and Services Tax (GST) on these food items. At the same time GST (Goods and Services Tax) will have to be paid on the charge levied by the banks for issuing checks.

Officials said the GST Council has accepted most of the recommendations of the group of finance ministers of the states. The Council is the apex decision-making body on matters relating to GST. The recommendations of the group of finance ministers of the states came before the council with a view to rationalizing the GST rates. Most of this has been accepted. The GST Council, headed by Union Finance Minister Nirmala Sitharaman, also includes state finance ministers.

The council on Tuesday, on the third day of its two-day meeting, accepted the recommendations of the Group of Ministers (GoM) on reviewing the exemption from GST. This exemption is currently available for packaged and labeled food items. Along with this, products like canned meat (except frozen), fish, yogurt, cheese, honey, dried beans, soybeans, peas, wheat and other grains, wheat flour, handfuls, jaggery and organic fertilizers will now be subject to five per cent GST.

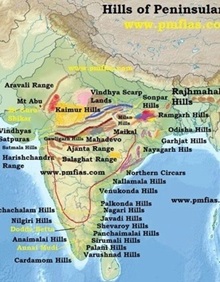

Similarly, 18 per cent GST will be levied on the charges levied by banks on issuance of checks. Maps and charts, including atlases, will be subject to 18 per cent GST. At the same time, GST exemption on unbranded products sold in the open will continue. Apart from this, hotel rooms renting less than Rs 1,000 per day will be taxed at 12 per cent. There is currently no tax on it. Rationalization of rates is important to increase the weighted average GST. The weighted average GST has come down to 11.5 per cent from 12.5 per cent at the time of implementation of this tax system.

The council on Wednesday may consider a demand for the states to continue the compensation system beyond June 203 to compensate for the loss of revenue. Apart from this, important issues like levying 5% GST on casinos, online gaming and horse racing are likely to be discussed. Opposition-ruled states like Chhattisgarh are demanding an extension of the GST compensation system for five years or an increase in the state's share of revenue from the current 50 per cent to 20-30 per cent.

Author : Gujaratenews

Related Articles

હોર્મુઝમાં તણાવ, સુરત સુધી અસર!...

15-Jan-2026

02-Feb-2026