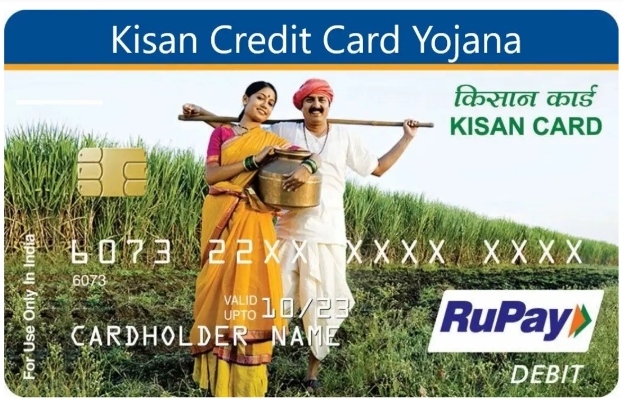

કિસાન ક્રેડિટ કાર્ડ પર ખેડૂતોને 3 લાખ રૂપિયા મળે છે, તમે આ રીતે બનાવેલું તમારું KCC મેળવી શકો છો

30-May-2022

ગુજરાતી ભાષામાં અનુવાદ કરો

Farmers get Rs 3 lakh on Kisan Credit Card, you can get your KCC made this way

Kisan Credit Card Application: Under the Central Government's Kisan Credit Card Scheme, farmers will get a loan of up to Rs 3 lakh. Farmers will also be able to buy tractors and other agricultural implements from the loan amount available on this Kisan Credit Card! Today in this article we will talk about the Central Government's Kisan Credit Card Scheme. It will also tell you how to create your own Kisan Credit Card! And how to get a loan of three lakh rupees from him! The scheme is being run by the Central Government. And this Kisan Credit Card is also called KCC (KCC Scheme).

Kisan Credit Card Application

The Kisan Credit Card Scheme was started by the Central Government in the year 1998. At that time the farmers of the country were taking loans from usurers at high interest rates for farming. And if the KCC (KCC scheme) loan was not repaid on time, the usurers would take possession of the farmers' land. That is why the central government launched the Kisan Credit Card Scheme with the objective of providing low interest agricultural loans to farmers. But at that time the farmers were not interested in this Kisan credit card scheme.

But after the launch of Pradhan Mantri Kisan Credit Card Scheme in the year 2019, the farmers gave their full support to this Kisan Credit Card Scheme! This is because the central government made this Kisan Credit Card mandatory to avail the benefits of Pradhan Mantri Khedut Yojana. However, now the mandatory requirement of this KCC (KCC scheme) has been abolished. About 56% of the country's farmers have so far created their Kisan Credit Card.

Farmers will get Rs 3 lakh

Farmers who have created their Kisan Credit Card! With this Kisan Credit Card you can get a loan of around Rs. 3 lakhs from a bank. These loans are given to farmers at very low interest rates. As well as the loan amount is given to the farmers for one year. After one year (Kisan Credit Card Scheme), farmers will have to deposit this amount back in the bank. Farmers use this amount to complete farming works. Or buy agricultural implements like tractors etc. If for some reason the farmer is unable to repay the loan in one year. So the farmer by contacting his limited branch! You can extend the term of your KCC (KCC scheme) loan up to one year.

Documents required for Kisan Credit Card

Under this Prime Minister's Kisan Credit Card Scheme of Central Government! To Get Your Own Kisan Credit Card! The farmer needs to have all the necessary documents. If you are also a farmer! Thinking of creating your own KCC (KCC Scheme)! So you must have your own Aadhar Card, Identity Card, Land Thasra Number, Land Acceptance and Bank Passbook! Without these documents, no farmer will be able to create his Kisan Credit Card.

Get Your Kisan Credit Card Made This Way (Kisan Credit Card Application)

First of all, the farmer has to go to the official website of the Prime Minister's Kisan Credit Card. (The official website link is below!)

Click on "Download KCC Form" under "Farmer's Corner" on this official website.

After this you can easily download "PM Kisan Credit Card"!

After downloading this form, fill in all your information in correct and clean letters.

Now submit this form along with proper documents to the nearest bank branch.

After this, in the next seven days, the farmer will get his own Kisan credit card.

Official website link - pmkisan.gov.in

By downloading your Kisan Credit Card application form from the official website of Pradhan Mantri Kisan Credit Card Scheme. (Loan) You can create your own Kisan Credit Card! Very few documents are required by banks for making Kisan Credit Cards for farmers. To create KCC (KCC Scheme) under Kisan Credit Card Scheme, the farmer has to submit this application form to the bank along with all the documents. Shortly after submitting the application, the farmer will receive his own Kisan Credit Card.

Author : Gujaratenews

Related Articles

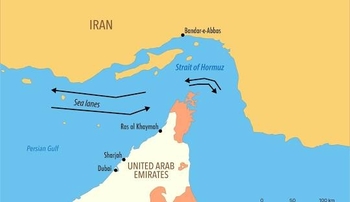

હોર્મુઝમાં તણાવ, સુરત સુધી અસર!...

15-Jan-2026

02-Feb-2026