ક્રેડિટ કાર્ડ ચુકવણી: જો તમે પણ ક્રેડિટ કાર્ડની ન્યૂનતમ બાકી રકમ ચૂકવો છો, તો તેના ફાયદા અને ગેરફાયદા જાણો...

17-May-2022

ગુજરાતી ભાષામાં અનુવાદ કરો

Credit Card Payments: If you also pay the minimum credit card balance, know its advantages and disadvantages.

Credit cards have become a status symbol these days. Many also consider it a credit card requirement. Some people also like to have more than one credit card. Credit cards have some advantages and some disadvantages. Today we are talking about credit card minimum due payment option.

If you have a bank credit card, you will also have a credit card bill for it. If you look closely at his bill, you will see the full amount of the bill in it. You will also see the option of minimum amount duno. This means you can also pay this amount. But this does not mean that you get rid of the credit card bill only after paying the minimum outstanding amount. Come on in, take a look at the advantages and disadvantages of choosing a minimum balance ...

There are two options in credit card bill payment

When you view your credit card statement, two payment options appear in the bill. Total outstanding amount and minimum outstanding amount. While the first option is fairly flat (i.e. the total amount you will have to pay if you want to pay it in full during the interest free period). But, looking at the second option, there may be some misunderstandings. Do you know what 'minimum balance' means?

The remaining minimum amount is a small fraction of your total bill amount. You need to pay this within the last bill payment deadline to continue using your credit card. By doing so, you also avoid additional penalties such as late payment fees on your outstanding balance. But most importantly, if you pay the minimum amount remaining, you will have to pay interest (usually at a rate of 3 to 4% per month) on the remaining bill amount. This means paying a higher interest rate of 30 to 40 percent per annum. It will also have to be paid from the day you buy it.

The minimum balance calculated on the date of statement is usually 5% of your outstanding balance. But this amount can be changed from bank to credit card. If the total amount owed on your credit card bill is higher, it may be less than five percent of that amount. If the total amount of the bill is less, it can be around five percent.

Yes. Paying only the minimum amount left over in a credit card bill can get you into debt. This is because the amount is used to pay interest, not the original amount. Interest will continue to accrue until you clear the amount owed. In addition, if you pay only the minimum outstanding balance and do not pay in full the credit card balance, you will not get the benefit of interest free credit period.

Is there any effect on CIBIL report?

Many credit card customers say they have been given important information by the card issuing bank. The information is that if the minimum outstanding amount is paid, the CIBIL score will not deteriorate. But experts say that when your loan amount stays up or down instead of down, the CIBIL score will go down. Not only that, the bank will identify you as a customer who has a shortage of liquidity. Such consumers are likely to be in debt in the coming days.

Will the credit limit also be affected?

Credit limits are also important in the use of credit cards. When you pay the minimum amount remaining on the bill, you will be in debt. Because, you don't pay big. In such a case, you will have to pay 30 to 40 percent annual interest on this amount, your credit limit will also decrease. You will also have to pay more interest as you will not get a free credit period of 50 or 55 days once you use this option. This means that interest will be added from the day the purchase is made. The less you pay on a credit card bill, the less money will be deducted from your credit limit.

Related Articles

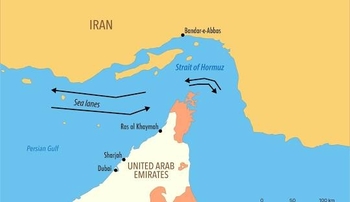

હોર્મુઝમાં તણાવ, સુરત સુધી અસર!...

15-Jan-2026

02-Feb-2026