ąŖ ąŖąŖ² ąŖŖą«ąŖØą«ąŖ¶ąŖØ ąŖÆą«ąŖąŖØąŖ¾ąŖ®ąŖ¾ąŖ ąŖ¦ąŖ° ąŖ®ąŖ¹ąŖæąŖØą« 5 ąŖ¹ąŖąŖ¾ąŖ° ąŖ°ą«ąŖŖąŖæąŖÆąŖ¾ ąŖŖą«ąŖØą«ąŖ¶ąŖØ ąŖ®ąŖ³ąŖ¶ą«, ąŖ¤ąŖ®ą« ąŖ ąŖ°ą«ąŖ¤ą« ąŖ°ąŖą«ąŖøą«ąŖą«ąŖ°ą«ąŖ¶ąŖØ ąŖąŖ°ąŖ¾ąŖµą« ąŖ¶ąŖą« ąŖą«

07-Jun-2022

ąŖ ąŖøąŖ®ąŖ¾ąŖąŖ¾ąŖ° ąŖą«ąŖąŖ°ąŖ¾ąŖ¤ą« ąŖąŖ¾ąŖ·ąŖ¾ąŖ®ąŖ¾ąŖ ąŖ ąŖØą«ąŖµąŖ¾ąŖ¦ ąŖąŖ°ą«

Atal Pension Yojana will get a pension of Rs. 5 thousand per month, you can register this way

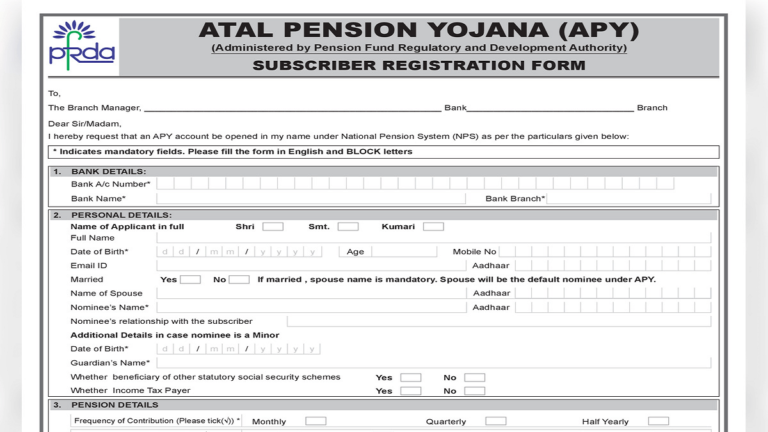

Atal Pension Yojana Registration: In this Atal Pension Yojana (PM Pension Yojana) run by the Central Government, you can easily get pension even by registering! Atal Pension Scheme is a type of pension scheme. Which pays its customers a pension after the age of 60. In that case, if you also want to be financially strong in your old age! So you must get your registration in the Atal Pension Scheme! In such a situation, today in this article we are going to tell you about this Atal Pension Scheme of the Central Government. Along with this we will also tell you how you can register yourself in this PM Pension Scheme.

Ā

Atal Pension Scheme Registration

Atal Pension Scheme is a type of government pension scheme. Under which any person will be able to register himself! And after the age of 60 you can get a pension. Many people also know this Atal Pension Scheme of the Central Government as PM Pension Scheme. Under the Atal Pension Scheme (APY) you can get the pension you want. But according to the terms of the scheme, the amount of pension cannot be less than 1 thousand rupees and not more than 5 thousand rupees. When registering in the Atal Pension Plan, the subscriber has to choose the amount of pension.

Ā

The Atal Pension Scheme was launched by the Central Government on 9 May 2015 in Kolkata by Prime Minister Narendra Modi. Earlier this Atal Pension Scheme was known as Swalamban Scheme. But in the year 2015, Prime Minister Narendra Modi changed the name of Swalamban Yojana to Atal Pension Yojana. And since then Swalamban Pension Scheme came to be known as Atal Pension Scheme. And old customers of Swalamban Pension Scheme have also been shifted to Atal Pension Scheme.

Ā

5 thousand rupees pension

According to the rules of Atal Pension Yojana (PM Atal Pension Yojana), customers can get a maximum pension of up to Rs 5,000 per month. The determination of the amount of pension (APY) under this Atal Pension Scheme of the Central Government is based on the amount of contribution made by the subscriber. That is the amount that the customer deposits as premium! According to that amount, he gets pension in Atal Pension Scheme. It would be fair to say clearly here! That is if a person deposits maximum amount in a form of premium amount in the plan. After the age of 60, he will get a pension of Rs 5,000 per month.

Ā

Documents required for PM Pension Scheme

aadhar card

Letter of introduction

Mobile number

Photocopy of bank passbook

2 passport size photos

Atal Pension Scheme Application Form

Employees who want to get pension under this Atal Pension Scheme of Central Government! They should have all the above documents (APY)! Without these documents, no employee will be able to get a pension under the Atal Pension Scheme. If an employee applies for PM Pension Scheme even without these documents! Therefore his application (PM Atal Pension Scheme) will be canceled!

Ā

Benefits of PM Atal Pension Scheme

The benefit of minimum pension under Atal Pension Scheme will be guaranteed by the Government in the sense that if the actual return on pension contribution is less than the estimated return for Minimum Guaranteed Pension (APY)! Therefore such deficit will be funded during the contribution period. On the other hand, if the actual return on pension contributions exceeds the estimated return for the minimum guaranteed pension. Then during the contribution period, such additional amount will be credited to the subscriber's account. As a result, the benefits of the scheme (PM Pension Scheme) will increase to the consumers.

Ā

How To Open Atal Pension Yojana Account (Atal Pension Yojana Registration)

If you are an employee! And wants to apply for a pension under this Atal Pension Scheme of the Central Government. So for this you have to open your Atal Pension (APY) account. To open an Atal Pension (PM Pension Scheme) account, you must have a savings account! If the customer does not have a savings account. So open a savings account. Give Bank Account Number / Post Office Savings Bank Account Number! Fill the Atal Pension Yojana registration form with the help of PM Atal Pension Yojana and bank employees. A mobile number may be provided to facilitate contribution related communication.

Author : Gujaratenews

02-Feb-2026